Where Do Your Autopac Payments Go?

Learn how local brokers keep your costs down

Choosing the Right Policy

Basic Autopac

The Protection You Need

Every Manitoba plated vehicle is mandated by the Manitoba Government to have Basic Autopac in order to be driven. For a majority of vehicle owners, this includes accidental physical damage to your vehicle, third party liability coverage and the Personal Injury Protection Plan (PIPP). If you choose to purchase Optional Autopac coverage with MPI, your Basic policy will still make up the largest portion of your overall insurance cost.

Optional Autopac

Tailor-made for your Life

Every driver has different needs for protection and if you need coverage beyond the Basic policy, it's called Optional Autopac. This can include selecting an assortment of Deductible Packages, Third Party Liability Coverage, Loss of Use Coverage and much more. Optional Autopac can either be MPI products or you can purchase a variety of options from other insurance companies to complement your basic MPI coverages available from your local insurance broker.

Cost Breakdowns

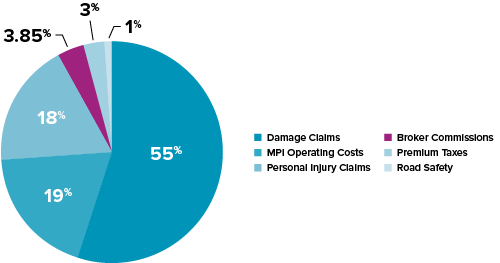

Basic Autopac

The main contributor to Operating Costs is salaries and benefits for MPI employees. Other categories of Operating Costs include data processing, advertising, printing, MPI building expenses, bank/merchant fees, furniture expenses, etc.

Some percentages have been rounded.

Percentages based on the average passenger vehicle policy

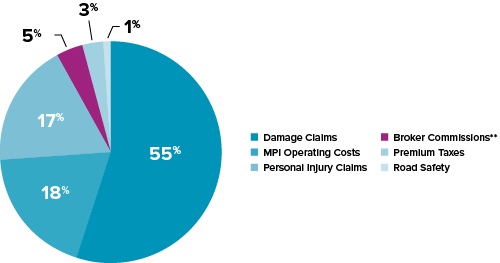

Total Autopac

(Basic + Optional Policies)

With our current broker model, Manitobans enjoy the lowest percentage of commission on Basic + Optional auto insurance against comparable systems in Canada.

In 2019, MPI total profits for Basic + Optional insurance were $135,558,000 or approximately 11.2% of the Basic + Optional premiums you pay. This equates to $153.72 per average total Autopac policy.

Some percentages have been rounded.

* - Total Autopac chart above does not include profits at MPI

** - In order to stay competitive, MPI pays brokers a higher commission on Optional Autopac to encourage the support of their products

Small commissions. Big impact.

For every Basic Autopac policy that brokers manage on behalf of MPI, they earn a 3.85% commission. With this small portion, brokers employ 2,600 Manitobans and operate 300 storefronts in 120 communities. These business owners have spent decades building a reliable service network across our province, and their commission allows them to continue their work, which is providing advice and protecting you from property and physical losses.

A model of excellence.

Independent brokerages are not funded through government spending and only earn commission when they deliver revenue to MPI. This broker model frees taxpayers from expensive overhead costs, including but not limited to, salaries, hiring, training, benefits, vacation pay, long-term leaves, long-term disability, parking, retraining, pension costs and office space. In other words, you get the convenience of having an Autopac expert in your community, without the burden of added cost.

For more information please contact your local broker. Find your broker here.